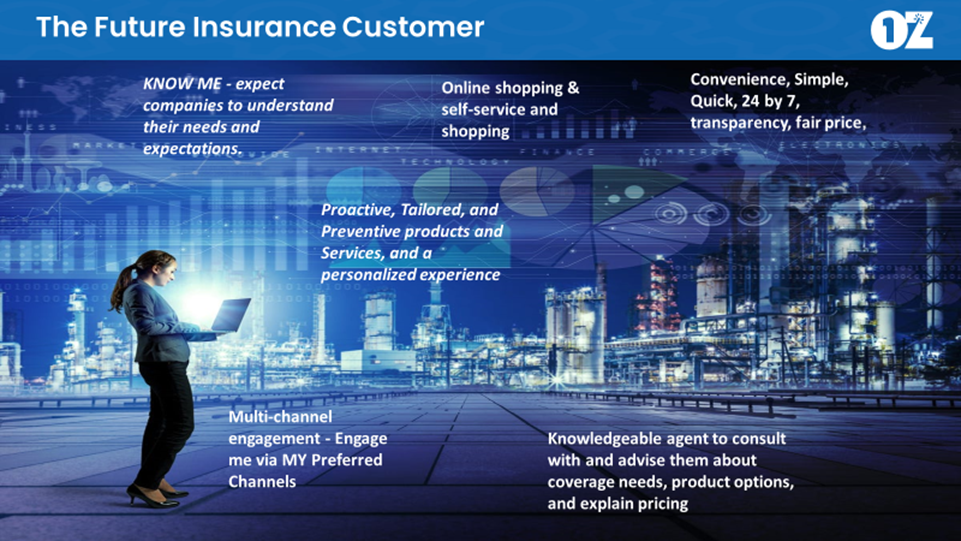

Insurance Companies are being challenged to rethink not just the customer experience they currently provide, but their entire approach to customer engagement. Insurance customer expectations keep soaring. While Insurers continue to accelerate their digital transformations, the expectations of Insurance customers for Digital Self-Service Channels and personalized experiences that consider their needs, wants, and behaviors dominate and continue to grow. (A recent report from Salesforce)

- 84% of customers say the experience a company provides is as important as its products and services

- 73% of customers say one extraordinary experience raises their expectations of other companies

- 66% of customers are willing to pay more for a great experience

- 54% of customers say companies need to transform how they engage with them.

- 52% of customers – including 56% of consumers – say companies are generally impersonal.

- 73% of customers expect companies to understand their needs and expectations.

- 62% of customers expect companies to adapt based on their actions and behavior

- 78% of customers expect to solve complex issues by speaking to one person.

- 68% percent would rather use self-service channels – like knowledge bases or customer portals – for simple questions or issues

Insurers will need to address the rising demand from consumers for more personalized solutions and experiences, increasing the need for rich and consistent customer data and personalized insights, expanding direct and digital sales and service channels, and creating broader service propositions, including the addition of smart preventive services to provide proactive and prescriptive prevention services, while still supporting and collaborating with agent and broker networks.

Contact Mark Smith, President of the Global Insurance Practice and Insurance Practice Leader, to discuss how Artificial Intelligence, Intelligent Automation, and process discovery can enhance customer interactions for your business.