Faced with too many time-consuming tasks, 70% of U.S. office workers believe they can’t efficiently help customers.

Roughly the same number (67%) feel they are constantly doing the same tasks over and over again.

The answer, in large part, is hiding in plain sight: In research conducted for UI Path, an OZ Partner, respondents said they waste four and a half (4.5) hours a week on tasks they think could be automated—more than five weeks a year. Surveyed executives also believe automation is helping their companies perform better by saving time (71%), improving productivity (63%), and saving money (59%). About 7 in 10 executives planned to increase their investment in automation tools in 2022 compared to 2021, and 90% of organizations had adopted RPA for automating business processes, automation driven by the C-Suite.

Further, 85% of U.S. business executives believe automation will help retain employees and hire new talent amid The Great Resignation.

And, as a recent survey conducted by Accenture and The Institutes revealed, the need for automation is particularly acute.

Administrative and non-core activities fill up to 40% of the underwriters’ time, with the rest split between their core functions: risk analysis/pricing and negotiation/sales.

Underwriters reported limited automation support for core and non-core activities. They expressed frustration with aging systems and inefficient processes.

Consider the following:

- Roughly 60% of underwriters cite a need for better processes and tools.

- Both commercial and personal lines underwriters named manual processes and outdated systems as the top two issues.

- Commercial underwriters cited a lack of information/analytics at the point of need as the third reason.

- On the other hand, personal lines underwriters cited insufficient training and time for talent development.

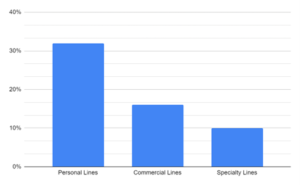

Available artificial intelligence (AI), robotics, and NLP tools were described as “superior” by only 32% of personal lines underwriters, 16% of commercial lines underwriters, and 10% of specialty lines underwriters.

Description: Underwriters citing available automation tools as “superior” (Survey conducted by Accenture in conjunction with The Institutes, Aug 2021, n=434)

The opportunity and challenge of insurance automation were summed up succinctly in a recent Celent report entitled, Do You Have Intelligence in Your Processing?

An excerpt:

In the insurance industry – where profit margins vary widely based on catastrophes on the property casualty side and are usually razor thin on the life side—improving operational efficiency, even by the smallest of increments, can have a highly beneficial impact. Fueled by digital acceleration, many insurers are turning to intelligent automation to optimize and digitize operations.

However, insurers are continually challenged with identifying new ways to invest in automation to improve operations with a high return value, such as the customer experience, with the ultimate goal of reducing costs and improving profitability.

Even small commercial insurance carriers face the “Amazon experience” challenge.

For insurance, automated service is a familiar experience for homeowners, renters, and drivers insured by larger carriers.

Rising service expectations are driving small commercial insurers’ adoption of automation tools.

Remember, small business owners are also consumers, their expectations are set by digital consumer capabilities.

- Forty-four percent (44%) of insurers expect an increase in direct sales to small commercial buyers. Demand for direct sales and service is driving an explosion in channels and technologies to meet buyers’ needs.

- Over eighty percent (83%) of executives expect big changes to small commercial underwriting within the next five years.

- Eighty-nine percent (89%) of insurers also plan or apply automated workflow technologies to their small business operations.

Where should insurance leaders invest to achieve “big changes” in automation?

Robotic process automation (RPA)—using software bots to handle routine keystroke-level tasks—enables employees to devote time to higher-value work, improves customer service, and creates new business opportunities.

RPA is more important than ever in the insurance industry. Novarica reported that sixty percent (60%) of insurers had deployed RPA in 2021, compared to less than a quarter in 2018.

Why RPA/automation is different now

Early RPA platforms dispatched rote tasks efficiently. Emerging technologies contributed to the development of RPA in the 1990s and early 2000s.

Among these:

- Advances in screen scraping software to extract data from programs, websites, and documents helped eliminate manual data entry.

- The first workflow automation software replaced basic, paper-based processes with electronic ones.

- Adding modeling tools and business rules helped make sense of business processes.

- The modern era of workflow automation, a predecessor technology to RPA, began with the introduction of business process management in 2005.

- The early 2000s brought the first RPA software success in automating repetitive tasks.

- Software developers expanded RPA capabilities, and the basic technology was well established by 2015.

With the advent of RPA informed by AI technologies, RPA technology has reached a booming point in the last several years.

Newer applications integrate artificial intelligence into RPA platforms to increase efficiency, improve customer experience, and reduce repetition for employees.

Applying advanced RPA typically follows a three-point process:

- The “robot carries out end-to-end processes.”

- Robots connect existing tools, so employees handle only exceptions.

- Cognitive technologies leverage AI to expand RPA possibilities and help organizations reach the next performance level.

Integrated RPA delivers on its promise.

As OZ works with insurers, we find eight repeatable wins for clients implementing integrated RPA.

- Boost productivity. Let humans do what humans do best and let robots handle the rest, to increase capacity and data processing by up to fifty percent (50%).

- Improve efficiency to lower operational costs. Typically, from twenty-five to fifty percent (25% to 50%).

- Eliminate human error. 100% data accuracy is feasible with automation.

- Improve data security and compliance. By reducing contact with sensitive data.

- Enjoy economies of scale and handle seasonal renewal peaks with ease.

- Leverage volumes of process data generated by RPA to improve analytics.

- Automate without disruption. Robots mimic user interactions—such as clicks and keystrokes—so RPA grafts successfully onto legacy systems.

- Improve the customer experience in quoting, underwriting, claims and policy administration—consistently.

Critical steps for insurers before implementing a single RPA bot.

If you only have a hammer, does everything look like a nail?

Attributed to Abraham Maslow, the “law of instruments” captures over-reliance on the tool.

As specialized automation vendors pitch their solutions, can they deliver for insurers?

At OZ, we know insurance. While RPA providers typically focus on developing generic bots and lack industry-specific automation expertise, we begin by understanding the job to be done.

For example, one of the challenges of implementing RPA is deciding which processes to automate. Consider Microsoft’s 18-step process to implement robotic process automation (RPA). Each of the eighteen steps requires critical decisions about workflow, approvals, implementation, security, regulatory compliance, data, and more.

- Define the pain points within your process and determine where to begin the automation initiative.

- Consider ways to leverage structured and unstructured data to expedite underwriting, claims, or customer service processes and make better decisions.

- Anticipate and measure the impact of RPA implementation.

-

- Leading RPA tool vendors, including OZ partner UI Path, recommend hard and soft “savings” measures.

- IBM suggests building in a “counter” to track items completed by RPA that used to be done by employees or outsourced staffing. Multiplying time saved by an average hourly rate easily converts items to hard savings.

- As bots reduce repetitive and error-prone tasks, Microsoft suggests “soft” metrics, including employee satisfaction, as people focus on more enjoyable and challenging work.

- Select the strongest use cases, typically including claims First Notice of Loss (FNOL), personal and small commercial underwriting, and policy administration.

Blending complementary, cutting-edge digital technologies such as RPA, Advanced OCR, AI, Workflow Orchestration, ML, and other cognitive technologies, OZ empowers insurance leaders to create efficient, effective automation ecosystems within their organizations.

OZ partners with insurers to leverage AI & Intelligent workflow solutions for Claims, Underwriting, submissions, call center, and renewal workflows.

Contact Mark Smith, President of the Global Insurance Practice and Insurance Practice Leader, to discuss how Intelligent Automation can streamline processing and enhance profitability for your business.